Fanny Koleva

ORCID iD: 0009-0002-9856-6303

University of National and World Economy, Sofia, Bulgaria

https://doi.org/10.53656/igc-2024.33

Pages 322-332

Abstract. The paper’s aim is to explore if business interest to utility model (UM) registration in Bulgaria changed with COVID-19 and in what direction. Based on empirical research for the period 2009-2023 (i.e. before and after COVID-19 beginning) the paper analyzes the registration activity in a few dimensions – intensity, change in time, fields of interest, origin and type of the owners, to outline the behavior in comparison with other groups of holders. The paper, moreover, analyzes as well if the motivation of business changed in the different years after COVID-19 beginning and how, to better investigate the pandemic’s influence on its interest in technical solutions protection via UM, before it concludes.

Keywords: utility models, COVID-19, registration activity, Bulgaria, businesses, technical solutions

JEL: D22, O31, O34

- Introduction

COVID-19 influenced all fields of life, in a negative direction usually, although some exclusions as the quick development and use of distance communication tools took place as well. No doubt, it also impacted the domains of businesses, especially SMEs (Veleva & Velev, 2023) and intellectual property, and on the interest of the different types of creators in protecting their intellectual results based on a registration (where applicable). This is true for the developers of technical solutions as well, for whom it can be assumed that the influence has been negative. On the other hand, the pandemic’s effect as concerns the technical solutions’ registration as intellectual property is probably not unequivocal, as far as publications already appeared (WIPO, 2022a) stating that the number of patent applications in some fields connected with COVID-19, such as therapeutics and vaccines, grew significantly.

Together with this, there are not many studies in this regard as it is to some extent early for an analysis of the registration activity considering the patent procedure’s length of several years. As concerns the utility models (UMs), however, the situation is different to some extent, because the registration takes several months usually, i.e. there is a basic empirical background suitable for such an analysis already. And as far as the regimes of the different countries in the field of UM registration are various (Molhova-Vladova, 2023) (and thus – hard for a comparison), the analysis will be realized based on the data of a single state – Bulgaria, with the aim to investigate if COVID-19 influenced on the business interest to UMs among the other types of applicants and in what directions, if so.

The paper’s attention is focused on businesses, as UMs are considered a tool for a fast and cheap protection of technical solutions and as such – suitable for them (Applied Research and Communications Fund, 2020; WIPO, 2022b). Moreover, the country’s legislators realized a reform in the regime of their protection in late 2006 (with the Law on Patents and Utility Model Registration), the purpose of which was to make the UMs more attractive for the applicants, including businesses. The time and data (Applied Research and Communications Fund, 2017; Koleva, 2021) correspondingly showed that the reform achieved its purpose on one hand, and that the businesses appreciated it in the highest extent, on the other.

Therefore, the paper will disclose the results of an empirical study analyzing the period 2009-2023, including a certain period before the pandemics, together with the years after its start, to conclude if such an influence is at hand, also comparing the businesses with other categories of applicants. The analysis is based on the publications of UM registrations in the Official Gazette of the Patent Office of the Republic of Bulgaria for the relevant period and is developed in a few dimensions – registration activity intensity and change in time, fields of interest (based on the International Patent Classification – IPC, https://www.wipo.int/classifications/ipc/en/), origin and type of the owners, in order to reach its conclusions.

- Registration activity in the field of utility models for the period 2009–2023

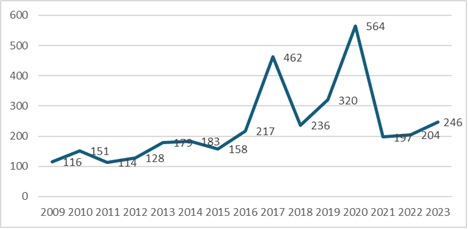

The data shows (see fig. 1) that a trend of a continuous growth is at hand before the pandemics (excluding a deviation in 2018). What it also discloses, however, is that after the beginning of COVID-19 in 2020, a sharp decline logically followed. On the other hand, it’s interesting to point out that the number of registrations reached its highest value in 2020, although the pandemics has already started. This could have two explanations – no influence of COVID-19 on the application (and consequently – registration) activity in 2020 was at hand or a high application activity in late 2019 took place, which led to a high number of registrations in the beginning of 2020. An earlier analysis on this issue (Koleva, 2024) comparing the registration activity in 2019 and 2020 on a monthly basis showed that the second explanation was the true one. The data processed for the current analysis purposes also show that the number of registrations in 2022 was almost the same as the one in 2021, while their number for 2023 indicates a clear positive change (and a beginning of a relevant starting trend, also confirmed by the figures for the first half of 2024, when the registrations were 280, compared to 246 for the twelve months of 2023). Or if it must be summarized, COVID-19 led to a sharp drop down in the applicants’ interest to UMs, which changed with the start of the restoration from the pandemics’ effects in all fields of life.

Figure 1. Registered utility models in 2009 – 2023 (in numbers per year)

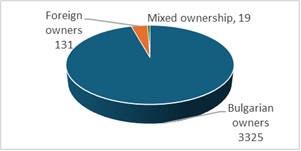

If the interest of applicants (and subsequent owners respectively) according to their origin must be analyzed, the data shows (see fig. 2) that the Bulgarian ones prevail for all the years in the investigated period, with about 96% for the fifteen years overally. The registrations, which took place in 2009-2023 on the name of foreign applicants were about 4%, and the ones that belonged jointly to Bulgarian and foreign parties were about half percent for the period. These figures make sense in any time, of course, as it is logical to have Bulgarian applicants most interested in UM protection in their own country, differently from foreigners. The variations in UM regulations between countries, on the other hand, probably make this form of protection less attractive for foreign applicants than others, e.g. patents, which are more harmonized and easier for management from this perspective. Together with this, the foreign parties showing interest in UM registration in Bulgaria originate from 34 states, which probably means that the country is attractive enough for different types of economic activities based on UMs.

Figure 2. Origin of the utility model owners for the period 2009-2023 (in numbers)

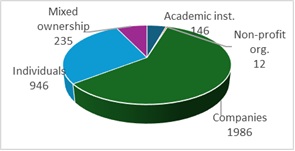

Figure 3. Type of Bulgarian utility model owners for the period 2009-2023 (in numbers)

Having in mind the figures cited above, the analysis in this part will predominantly proceed with the Bulgarian owners (and it will further refer again to the foreign ones), as the empirical background for them is more suitable for making really credible conclusions. The analysis of the interest of different types of Bulgarian applicants (and subsequently owners of UMs) shows (see fig. 3) that the businesses prevail, with about 60% of the registrations for the whole period (and with a prevalence at hand for almost all the years in it), followed by individuals, with 28%, proving again that the corporate sector appreciates in the highest extent the advantages of UMs considered more appropriate for some types of inventions than patents (Suthersanen, 2006). It is also important to mention that those figures definitely differ from the ones for patents, where the individuals usually prevail substantially and persistently, as the Annual report of the Patent Office of the Republic of Bulgaria (2023) and the Innovation.bg report (Applied Research and Communications Fund, 2018; Applied Research and Communications Fund, 2023) show. The businesses and individuals as UM owners are followed by the cases of joint ownership between more parties, of a different type usually (e.g. businesses and academic organizations, companies and individuals, etc.), with about 7% of the registrations for the period. This fact does probably show that the combined efforts of different types of applicants influence positively on the attitude of some of them to UMs, if they perceive this type of protection as a riskier one (compared to patents), which cannot be excluded having in mind the lack of obligatory substantive examination for UMs. And last, but not least, the interest of academic institutions and non-profit organizations to UMs must also be mentioned, although being low, with about 4% for the first category and less than a half percent for the second one.

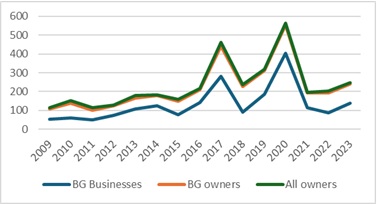

It is also interesting to analyze whether the interest of businesses to UMs changed with time and if so, in what direction. The data show (see fig. 4) that the corporate interest to UM registration duplicates what has already been found out generally for all the applicants (respectively registrants later). Not surprisingly, it also duplicates the interest of the Bulgarian owners in time, as visible on fig. 4 too. This is a logical analysis result, of course, as far as the Bulgarian businesses are the prevailing part of the UM owners for the period.

As concerns the influence of COVID-19 on the interest of Bulgarian businesses, it also confirms the general trends, i.e.:

– it has fallen with COVID-19, after an initial pick in early 2020 due to the high number of applications in late 2019,

– a restoration started in 2023 (and continued in 2024, having in mind that about 140 business registrations took place in its first half, compared to the same number for the whole 2023).

Figure 4. Utility models registered by Bulgarian businesses in 2009-2023 (in numbers per year), in comparison with the overall number of registrations

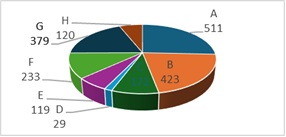

Regarding the fields of business interest, the data show (see fig. 5) that:

– the registrations in the field of human necessities (class A of the IPC) prevail, with about 26%, followed by the ones in the domains of

– performing operations and transporting (class B of the IPC), with about 21%,

– physics (class G of the IPC), with 19%,

– mechanical engineering, lighting, heating, weapons and blasting (class F of the IPC), with about 12%,

– chemistry and metallurgy (class C of the IPC), with about 9%,

– electricity (class H of the IPC) and fixed constructions (class E of the IPC), with about 6% for each of them,

– and textiles and paper (class D of the IPC), with 1%.

As can be seen from the data, the interest to the three leading classes relates to almost two thirds of the registrations, and the one to the four leading classes – to over three fourths. Moreover, almost half of the registrations belong to the first two classes. Those data show that the interest of Bulgarian businesses is mainly concentrated in the fields of human necessities satisfaction, together with the performing operations and transport, followed by the solutions in the domain of physics. Together with this, it must be pointed out that the data for all the registrations in Bulgaria for the analyzed period show the same interest of all applicants to the different technological fields as an order of the IPC classes and almost the same percentages, with the exclusion of class G (physics), where the businesses show a higher level of interest compared to the applicants as a whole – 19% against 17%.

It can also be added here that the interest of businesses is more dynamic than the interest of all the applicants showing that the companies are more sensitive and/or faster in their reactions to outer influences – the difference in the lowest and the highest number of corporate registrations for the whole period is more than 8 times, while the same number for all the registrations is about 5 times. It is an interesting question as well if the separate fields of technology show the same dynamics in business registrations. The data show that the interest of businesses is most dynamic in class B, with a difference of 25 times between the lowest and the highest value for the period, followed by class G, with a difference of 21 times between the lowest and the highest value. For a comparison, the same differences are around 11 times for the applicants (respectively registrants afterwards) as a whole. Said in other words, the businesses with an interest to class B and G seem to be more sensitive to outer influences and/or quicker in their reactions to them compared to individuals, academic institutions, etc. On the other hand, however, no changes of the business interest as concerns the technological field appeared after the beginning of COVID-19, meaning that the pandemics influenced mostly the general interest and did not cause a change from the perspective of the preferred specific fields of technology.

Figure 5. Utility models registered by Bulgarian businesses in the period 2009-2023 (in numbers), according to the field of technology

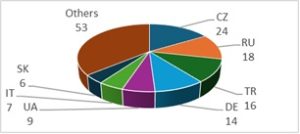

Figure 6. Origin of the foreign utility model owners for the period 2009-2023 (in numbers)

As concerns the foreign UM owners, the data show (see fig. 6) that Bulgaria seems to be most attractive for the applicants (and subsequently holders) from the Czech Republic, who possess 16% of the foreign registrations, followed by the ones from Russia, with 12%, Türkiye, with 11%, Germany, with 10%, Ukraine, with 6%, and others (up to 34 countries, as already mentioned). 55% of the foreign registrations belong to the representatives of these 5 leading countries and 64%, i.e. almost two thirds of the foreign registrations – to parties from the first 7 countries, also including Italy, with 5%, and Slovakia, with 4%. The rest of the countries are represented by holders with between 1 and 4 registrations. As can be seen from the list, the “foreign” registrations mainly belong to the representatives of countries with whom Bulgaria has close relations, due to different historical reasons.

If the profile of the foreign UM owners must be analyzed, the data show that 75% of the registrations belong to companies and the rest – to individuals. There are also 3 registrations belonging to a company and an individual (2 registrations) or a company and a scientific institution (1 registration). If they are also added to the number of corporate registrations, the relevant percentage becomes 77%. There is also a registration jointly possessed by companies from different countries.

If we refer to the leading foreign UM owners, the Czech Republic and Türkiye have 83% corporate registrations, Germany – 67% and Russia – 56%, showing that the businesses of those countries are more active than the other sectors. This makes sense, of course, as far as the intellectual property protection and the business in a foreign country based on it are generally considered riskier and more appropriate for companies than for individuals or scientific institutions. On the other hand, the foreign businesses seem to recognize the value of UM protection per se in a greater extent compared to the rest of the applicants. The only exclusion in this regard among the top five countries relates to the applicants from Ukraine, with strongly prevailing number of registrations on the part of individuals.

As concerns the joint ownership between Bulgarian and foreign parties, the partnerships between individuals prevail, with 63% of the registrations, which can probably be explained with the higher risk for individuals and the necessity to reduce it based on partnerships. The joint corporate registrations mark 16%, followed by the partnerships of scientific institutions and of scientific institutions and individuals, with about 11% each, the last two ones reflecting a low level of activity of the categories of individuals and science. The partnerships for joint UM ownership are with parties from Germany, Ukraine, the Czech Republic and Russia, being the most active foreign owners, as mentioned above, but also with ones from Italy, Saudi Arabia, Belarus, South Africa, France and Great Britain.

Regarding the interest of foreign applicants to the different technological fields, some variations are at hand in comparison with their Bulgarian “colleagues” – the registrations in the domain of mechanical engineering, lighting, heating, weapons and blasting (class F of the IPC) are second in number, with 19% (following class A in the first position with 27%), showing a higher level of interest in this field than the Bulgarian applicants have, and outpacing the performing operations and transporting (class B of the IPC, with 16%), because of the lower interest in it. The fourth position belongs to the field of fixed constructions (class E of the IPC), with 13%, where the foreign applicants again have a higher interest than the Bulgarian ones. This probably means that the foreign parties consider the Bulgarian industry being a competitor in the fields covered by classes F and E of the IPC, which creates for them a motivation for UM protection in the country. The last positions in the interest are the ones of physics (class G of the IPC), with 9%, chemistry and metallurgy (class C), with about 8%, electricity (class H of the IPC), with about 7%, and textiles and paper (class D of the IPC), with about 1%.

As concerns the foreign interest to specific technological fields, the applicants from the Czech Republic came in a possession of 60% of the non-Bulgarian registrations in class C of the IPC (chemistry and metallurgy), with two thirds of them belonging to companies (one being in a partnership with a scientific institution), and of 33% in class G (physics), all of them corporate ones. The applicants from Russia are the leading ones in class F, with 32% (and 75% of them belonging to companies) of the non-Bulgarian registrations (followed by 24% for the Czech Republic in that class, all of them corporate ones again, one with a company from Switzerland), and in class E (fixed constructions), with 23% of the foreigners’ registrations, all of them corporate ones. Türkiye has its leading positions in class H (electricity) among the applicants from foreign countries, with 33% of their registrations, all of them belonging to companies again (one of them together with an individual). These figures seem to show that the businesses of those three countries consider the named sectors being competitive ones of the Bulgarian economy. Otherwise, they would not concentrate their efforts for protection in them.

Regarding the registrations in a joint possession by Bulgarian and foreign parties, the main field of the relevant interest is class C (chemistry and metallurgy), with 47% of the “mixed” registrations, proving again the competitive character of this sector of the Bulgarian economy. Apart from this, no other representative conclusions can be made as concerns the interest of foreign applicants/ones in multinational partnership, due to the law number of those registrations (less than 9 yearly for the foreigners on average, and less than one per year for the mixed nations partnerships), including regarding its change after the beginning of COVID-19.

- Conclusion

The results of the analysis realized for the purposes of this paper can be summarized as follows:

– after a definite growth trend in UM registrations in the period 2009 – 2019, and a following peak in early 2020 (outcome of the high application activity in late 2019), their number dropped drastically down after the beginning of COVID-19, to start raising again in 2023 (and further in the first half of 2024), which is true for the registrations of all categories of Bulgarian holders, including businesses;

– the UMs registered in Bulgaria in the period 2009 – 2023 belong mainly to local parties (with 96%), among whom businesses prevail (with 60%), followed by individuals (with 28%) and others. As concerns the foreign UM owners, they originate from 34 countries, the main ones being from the Czech Republic, Russia, Turkey, Germany and Ukraine (with 55% of the foreign registrations totally). Among the foreign owners, the corporate holders prevail even in a greater extent, with 75%, showing a certain level of interest to the Bulgarian economy. Their number, however, is low enough not to allow making any definite conclusion for the influence of COVID-19 on their interest to UMs;

– the national and the foreign applicants (including businesses) show their main interest in the field of human necessities (class A of the IPC), while they differ in their second (and third) interests – in performing operations and transporting (class B of the IPC, followed by class G) for Bulgarians and in class F for the foreigners (followed by class B for them). The same refers to the fourth interest, with class E for the foreign applicants (compared to class F for Bulgarians, while E is at the seventh position for them), and the following, and shows that the foreigners sometimes appreciate the competitive fields in the country differently from their local “colleagues” (which is best illustrated by the positions of classes F and E of the IPC). As concerns the influence of COVID-19, no such one is detected regarding the interest according to the field of technology for the Bulgarian applicants, as well as for their foreign colleagues. The last proves that the pandemics rather impacted on the general registration activity, than on the one according to the technological field (i.e. no change in the preferred fields is at hand after its beginning);

– the foreign UM owners sometimes show a specific interest to a definite field of technology, which is different according to their origin, with the most definite examples being the representatives of the Czech Republic in the domains of chemistry and metallurgy (class C of the IPC), with 60% of the non-Bulgarian registrations (and 67% of the registrations from that country being corporate ones), followed by the ones of Russia in class F of the IPC (75% of which are corporate) and some others. This is another evidence of the foreign interest to specific Bulgarian sectors, considered competitive by the non-national businesses (which interest again has not been influenced by COVID-19 in its direction, as the data show);

– there are also examples of both cross-sectoral and cross-national, i.e. joint registrations of UM by different parties, incl. businesses, although low in numbers, showing that if the UM potential is appreciated as a tool of technical solution protection and corresponding potential growth, the way to it can definitely be found, even if it is considered a riskier instrument compared to other types of intellectual property and even if it is used in more challenging times, such as the period around COVID-19 (for the impact of which on them no specific conclusions can be drawn because of their low number – less than one per year on average).

REFERENCES

Applied Research and Communications Fund. (2023). Innovation.bg: Innovation and Sustainable Growth. ARC Fund. https://arcfund.net/wp-content/uploads/2024/01/INNO_2023_ENG_WEB_1901.pdf

Applied Research and Communications Fund. (2020). Innovation.bg: Economic Resilience through Innovation. ARC Fund. https://arcfund.net/wp-content/uploads/2023/03/INNO_2020_ENG_WEB.pdf

Applied Research and Communications Fund. (2018). Innovation.bg: Smart Policies for Innovation Growth. ARC Fund. https://arcfund.net/wp-content/uploads/2023/03/INNO_2018_ENG_FINAL.pdf

Applied Research and Communications Fund. (2017). Innovation.bg: Bulgaria in the Global Value Chains. ARC Fund. https://arcfund.net/wp-content/uploads/2023/03/INNO_2017_ENG_WEB.pdf

Koleva, F. (2021). Analysis of Utility Model Registration Activity Development Influenced by Legislative Changes in 2006. In T. Nedeva (Ed.), Industrial Growth Conference 2020: Conference Proceedings Book (pp. 112-118). Publishing Complex – UNWE. https://www.industrialgrowth.eu/wp-content/uploads/2021/07/IG-Conference-2020-E-Book.pdf

Koleva, F. (2024). COVID-19 Influence on the Utility Model Registration Activity in Bulgaria. International Journal of Intellectual Property Management, 14(3), 256 – 273. https://doi.org/10.1504/IJIPM.2024.138327

Law on Patents and Utility Model Registration. (2006). Last amended in 2023.

Molhova-Vladova, M. (2023). Utility Models. In H. Vanhees (Ed.), International encyclopaedia of laws: Intellectual property, Suppl. 89 (pp. 111 – 117). Kluwer Law International.

Patent Office of the Republic of Bulgaria. (2023). Annual Report. https://www.bpo.bg/uploaded/files/1359-1359-GODIShEN-OTChET-2023-PV.pdf

Suthersanen, U. (2006). Utility Models and Innovation in Developing Countries. International Centre for Trade and Sustainable Development (ICTSD). https://unctad.org/system/files/official-document/iteipc20066_en.pdf

Veleva, S. & Velev, M. (2023). The Role of Innovation for Post-Crisis Recovery of Small and Medium-Sized Enterprises. Strategies for Policy in Science and Education, 31(3s), 117 – 125. https://doi.org/10.53656/str2023-3s-9-inn

World Intellectual Property Organization (WIPO). (2022a). Patent Landscape Report: COVID-19-related vaccines and therapeutics. Preliminary insights on related patenting activity during the pandemic. https://www.wipo.int/edocs/mdocs/mdocs/en/wipo_ip_covid_ge_22/publication_1075_e.pdf

World Intellectual Property Organization (WIPO). (2022b). Utility models. https://www.wipo.int/patents/en/topics/utility_models.html