Tanya Panayotova

ORCID iD: 0000-0001-5230-5891

Technical University of Varna, Bulgaria

https://doi.org/10.53656/igc-2024.28

Pages 386-396

Abstract. In the modern economic environment, the awareness of owners and managers about the value of the company is an important precondition for its effective management. Determining the value is a complex process because it changes over the time and depends on many criteria. The assessment of the value is essential not only for the development of the individual enterprise, but also for the directions and growth rates of each industry and the economy as a whole. The purpose of this research is to determine the main components of value that should be managed. It is found that for the adequate approximation of the value of the company, it is necessary to consider the value of the “intangible assets”.

Keywords: Value, ROIC, Growth, Intangible Assets, Customer Lifetime Value

JEL: L53, L21, D46

- Introduction

In today’s environment, businesses face new and greater challenges due to growing globalization and advances in scientific and technological progress. Organizations must continually adapt their business processes and procedures to effectively meet the demands, expectations and needs of both customers and competitors (Dimitrova, 2018).

In a constantly changing world, there is a need for new approaches to analyze and assess economic activities, helping investors and managers make informed decisions about the true potential of industrial enterprises in the context of their development. The value of an enterprise draws the attention not only of owners and managers but also of all stakeholders involved in its operations, such as employees, suppliers, customers, creditors, investors, governments and others. The supply chain focuses on the procurement of materials and the delivery of goods to customers. Meanwhile, the value chain extends beyond the sale of goods and products by offering added value through after-sales support (Dimitrova, 2024a).

The rise of technology has significantly impacted supply chains and financial transactions. The opportunities for innovation in supply chains through blockchain technology include the use of smart contracts, process transparency, and cost reductions in inventory management, among others (Dimitrov et al., 2022). The effectiveness of applying blockchain technology to improve the efficiency and competitiveness of supply chains largely depends on the level of outsourcing by the companies involved, the use of third-party logistics providers and their strategic intentions in this area (Dimitrov & Gigov, 2022).

The assessment of value is crucial not only for the development of individual enterprises but also for shaping the direction and growth rates of each industry and the economy as a whole. Determining value is a complex process, as it changes over time and depends on various criteria. It can be defined as the monetary worth of an asset, with each value having a price for which it is paid. In his book Investment Policy, American professor Aswath Damodaran highlights a well-known principle: ‘An investor does not pay more for an asset than it is worth” (Damodaran, 2012). The author of this study also fully supports the views of Charles Dow, one of the founders of the American Dow Jones Index, who famously stated: ‘The problem with investors is that they know prices, but not values!” (Bishop, 1960).

Business valuation is a tool through which the modern concept of Value-Based Management (VBM) can be implemented. This concept is currently recognized by economists as the primary paradigm for business development. In developed markets, VBM is well-established and widely used as an effective economic tool for company management. According to the concept, it is advisable to move away from ineffective accounting criteria for evaluating business success and instead base evaluations on a more straightforward and understandable metric for shareholders and investors: added value.

In Bulgaria, the concept is still only partially applied, as companies tend to follow the traditional financial management model, which focuses on increasing accounting profit. While the application of VBM is justified, directly adopting Western practices is not entirely suitable due to the unique characteristics of business operations in the country. However, a scientifically grounded application of value management principles can create the conditions for improving the effectiveness of management decisions within companies, aligning the interests of all stakeholders and providing a realistic assessment of growth and profitability prospects.

The purpose of this research is to identify the key components of value that must be effectively managed within a company. To adequately estimate a company’s value, it is essential to consider the impact of “intangible assets.” A combination of empirical and theoretical research methods was employed to achieve this objective.

- Key components in the value creation process

According to Pratt (2008), the value that companies create is the present value of the difference between cash inflows and the costs of investments made, accounting for the fact that future cash flows are worth less than today’s due to the time value of money and the uncertainty of future cash flows. By examining both revenue growth and a company’s return on invested capital (ROIC), it becomes possible to determine how revenue translates into cash flow and income. This implies that the value a company generates is driven by its ROIC, revenue growth and its ability to maintain these over time.

Several authors (Copeland, Koller & Murrin, 2000; Pratt, 2008; Koller, Goedhart & Wessels, 2015; Jiang & Koller, 2007 etc.) agree that companies are efficient only when the return on invested capital exceeds the cost of capital. When this condition is met, the company creates added value.

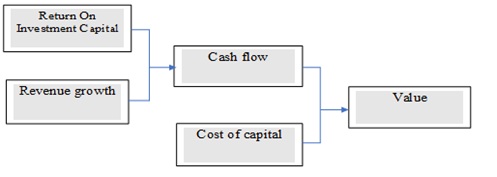

As discussed, the factors determining the amount of value created include the company’s return on invested capital (ROIC), revenue/profit growth (g), cash flow (CF) and cost of capital. The basic framework of this value creation process is illustrated in Fig. 1.

Figure 1. A basic framework of the value creation process Source: Koller, Goedhart & Wessels, 2015

To assess the impact of each component on the value being created or destroyed for the company, this study examines them from a strategic perspective.

a. Return on invested capital

The simplified definition of ROIC is the operating profit after taxes (NOPAT – Net Operating Profit After Tax) divided by the invested capital Ic (working capital plus fixed assets), which is mathematically represented by Equation 1.

![]()

Equation 1.

The operating profit NOPAT and the invested capital Ic are derived by dependencies presented by Equations 2 and 3.

![]()

Equation 2.

where:

– Roa – revenue from operating activity;

– Eoa – expenses for operational activity;

– Т – tax rate.

![]()

Equation 3.

ROIC is a key factor that significantly influences a company’s strategic and investment decisions. It stems from the firm’s competitive advantage, which requires an understanding of the sources of that advantage. To establish the relationship between the company’s adopted strategy, its competitive advantage and the return on invested capital, ROIC is expressed through the relationship described in Equation 4.

![]()

Equation 4.

In this representation, NOPAT is considered relative to a calculation unit, divided by the capital invested per unit (i.e., cost per unit of output and capital invested per unit of output). Therefore, the greater the difference between the selling price and the costs incurred to produce a product, the higher the ROIC, which reflects a firm’s competitive advantage. If a company has a competitive advantage, it will report a higher ROIC, either by producing its products more efficiently (at lower costs) or by charging a price premium. Any company can manage its ROIC by understanding and analyzing its sources of competitive advantage. The company’s chosen strategy drives its competitive advantage, which, in turn, leads to ROIC growth and ensures its sustainability. Companies with the highest ROIC growth are often those that combine multiple advantages. Koller et al. (2015) identify the following sources of competitive advantage:

– Price premium: Innovative products, quality, brand, customer lock-in, rational price discipline.

– Cost and capital efficiency: Innovative business methods, unique resources, economies of scale, scalable products/processes.

Although modern competition, especially in high-tech industries, is no longer solely based on price, costs have always been and will continue to be, one of the most powerful tools for gaining competitive advantage. In consumer goods industries, costs remain the most crucial factor.

Effective relationship management with all stakeholders is another important source of competitive advantage. Relationships not only connect the elements of a company’s value chain but also create interdependencies between its chain and those of suppliers, partners, and other stakeholders. By optimizing these relationships, companies can gain a significant competitive advantage (Dimitrova & Kadieva, 2023).

To ensure a high level of competitiveness and adaptability, companies need to implement a social business strategy integrated into their strategic goals (Biolcheva & Valchev, 2023). Another emerging source of competitive advantage is the application of artificial intelligence (AI). AI has the potential to significantly boost economic competitiveness while also advancing social and environmental objectives (Biolcheva & Sterev, 2024).

b. Rate of of income / profit growth (g).

Many authors have noted that the rate of income growth is often viewed as an external parameter, independent of a company’s specific condition. A. Damodaran (2012) introduces a new model, which posits that the growth rate can be determined using functional indicators such as return on invested capital (ROIC) and the investment rate, as illustrated in Equation 5.

![]()

Equation 5.

Investment rate (IR) is the portion of NOPLAT invested back into the business:

![]()

Equation 6.

Net investment is the increase in invested capital from one year to the next:

![]()

Equation 7.

When executives plan for growth, a good starting point is for them to disaggregate revenue growth into its three main components (Sven et al., 2008):

– Portfolio momentum: This is the organic revenue growth a company enjoys because of overall expansion in the market segments represented in its portfolio;

– Market share performance: This is the organic revenue growth (or reduction) a company earns by gaining or losing share in any particular market;

– Mergers and Acquisitions (M&A): This represents the inorganic growth a company achieves when it buys or sells revenues through acquisitions or divestments.

c. Cash flow (CF)

The third component in the model shown in Fig. 1 represents the cash flow generated by business activities, which is the most effective indicator for accurately assessing a company performance. Several authors, including Damodaran (1994, 2001, 2012), Madden (1998, 1999) and Copeland, Koller & Murrin (2000), as well as Martin and Petty (2000), view discounted cash flows as a reliable tool for estimating a company value. Free cash flow (FCF) refers to the cash generated by the core operations of the business after accounting for investments in new capital:

![]()

Equation 8.

Another way to look at this comparison is in terms of cash flow:

![]()

Equation 9.

d. Cost of capital. Weighted average cost of capital (WACC).

“Everything in this world has a price!” This principle also applies to capital. Whether equity is invested in a business, project, or asset, there is always a cost associated with it. Investments can be financed using a combination of equity and debt capital in a specific ratio. This ratio can be optimal, meaning it maximizes the firm’s value or purpose.

When valuing a company that is financed with both equity and debt capital, it is essential to determine the weighted average cost of capital (WACC). According to the International Valuation Standards (IVSC, 2017) and the Bulgarian Valuation Standards (CIAB, 2018), WACC is one of the applicable methods for establishing discount factors. In most literature, the equation for WACC is presented in the following form:

![]()

Equation 10.

Where

D∕V = target level of debt to enterprise value using market-based (not book) values

E∕V = target level of equity to enterprise value using market-based values

kd = cost of debt

ke = cost of equity

Tm = company’s marginal income tax rate

- Analysis of situations creating value in the company

Since the three variables (Growth, ROIC and Cash Flow) are mathematically interrelated, a company’s performance can be represented using only two of them. Typically, a company’s effectiveness is measured through growth and ROIC, both of which can be analyzed over time and in relation to competitors. A scenario-based approach has been applied in analyzing situations that create or erode a company’s value. This study presents a theoretical analysis of the structure of causal relationships that will alter value under the influence of various factors. After developing the scenarios, a strategy can be proposed for each one, aimed at maximizing the likelihood of achieving the company’s goals.

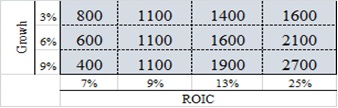

This research examines 12 scenarios of different combinations of growth and ROIC, using an example of a company that hypothetically earns 100 BGN in the first year. Each cell in the matrix represents the present value of future cash flows based on each assumption for growth and ROIC, discounted at a 9% weighted average cost of capital for the company.

The matrix presented in Fig. 2 illustrates the various combinations of the two variables. It is evident that for every level of growth, the company’s value increases when there are improvements in ROIC; that is, when all other factors are equal, a higher ROIC always enhances value. However, the same cannot be said for growth. When ROIC exceeds the cost of capital, faster growth increases value. But when ROIC is lower than the company cost of capital, faster growth destroys value. When ROIC equals the cost of capital, a dividing line can be drawn between value creation and destruction due to growth. On this line, value is neither created nor destroyed, regardless of how quickly the company grows.

The matrix in Fig. 2 contains the most important strategic insights regarding the company’s value, resulting from the relative impact of changes in ROIC and growth.

Figure 2. Turning Growth and ROIC into Value (Author)

Achieving the company’s desired results presupposes full coverage of the value-forming components. The existence of invisible and unvalued assets takes the value approach „one step back“ from the idea of adequate management and value maximization. In the conditions of a dynamically changing economy and an economy based on knowledge, the influence of intangible assets is becoming more and more tangible. In this study, additional indicators are proposed that could be useful for the evaluation and adequate approximation of the value of the firm.

- Additional components for adequate approximation of the value of the company.

a. According to the Bulgarian Valuation Standards (CIAB, 2018), reputation is an intangible asset that represents any future economic benefit arising from the activities of an enterprise, its participation in an enterprise, or the use of a group of assets, where this economic benefit does not stem from a specific identifiable asset. The value of reputation can vary depending on the purpose of the valuation and includes elements such as: business-specific synergies resulting from a business combination (e.g., reductions in operating costs, economies of scale or changes in product mix); opportunities to expand the business into new and diverse markets; benefits from a concentrated workforce (excluding intellectual property created by members of that workforce); benefits that can be derived from future assets, such as new customers and technologies.

b. Customer Lifecycle Value (CLV). Customer relationships have become a significant driver of value for many companies, especially in the “new” economy driven by knowledge and high technology. As a result, understanding customers and their behaviour, along with their profitability (as reflected in the CLV metric) has become increasingly important to companies’ strategic goals, as well as their operational and financial results. CLV is an important metric that can also be used when valuing companies and intangible assets. CLV is the present value of all current and future profits generated by the customer while she/he remains (lifetime) with the company. The CLV estimation formula can be presented as follows: (Gupta et al., 2006).

![]()

Equation 11.

CLV can be used in company valuations, particularly for startups and early-stage companies that may have negative profitability or even limited revenues. It is an important and useful indicator for operational and management purposes, as well as for valuing intangible assets and companies. CLV can be calculated using various methods, ranging from detailed approaches to high-level estimations. When customers are a significant factor in a company’s value, forecasts related to customers, based on CLV or other methods, should be conducted with the appropriate level of detail to reflect true behavior and financial effects. In such companies, the key value drivers include the customer acquisition rate, customer acquisition costs, retention rate, and margins. For early-stage companies in the “new economy”, CLV can be a valuable method for assessing and adequately approximating the company value.

c. Compliance with Environmental, social, and governance (ESG) criteriaCompanies have recognized that adhering to ESG criteria enables them to mitigate environmental risks, and that demonstrating social responsibility positively impacts customer loyalty while strengthening their market position (Vostrikova & Meshkova, 2020). By following ESG principles, companies gain several advantages, including increased attractiveness to investors and financial institutions, improved financial performance, and enhanced labor productivity. In the long run, compliance with ESG standards can lead to a better business reputation, create a positive corporate image, reduce environmental tax liabilities and foster technological advancements and innovation. Numerous studies have found a positive correlation between ESG performance and the value of public companies.

- Сonclusion

In the modern economic environment, the awareness of owners and managers regarding the value of their enterprises is crucial for effective management. Valuation is essential not only for the growth of individual companies but also for shaping the trajectories and growth rates of entire industries and the economy at large. The primary components that need to be managed are growth and return on invested capital (ROIC). Research indicates that growth at a lower rate of return can actually diminish a company’s value. Therefore, companies with a low ROIC can generate more value by concentrating on improving this specific variable. Conversely, firms with a high ROIC can create additional value by focusing on increasing their growth rather than their ROIC. In addition to these primary components, it is essential to consider intangible assets that offer future economic benefits for a more accurate estimation of a company’s value. This process necessitates a significant degree of responsibility and commitment from businesses, society as a whole, and individuals. Achieving this requires cultivating a new public attitude and a culture of responsibility towards nature and future generations (Dimitrova, 2024b).

Determining enterprise value through specific valuation methods, along with analyzing its dynamics and value factors, aims to provide reliable information that can guide management decisions effectively based on the current economic conditions. This is accomplished through a comprehensive set of research procedures. Such research can identify weak points within the enterprise and detect trends toward growth or decline.

REFERENCES

Biolcheva, P. & Sterev, N., (2024). A Model for Calculating the Indirect Added Value of AI for Business. Strategies for Policy in Science and Education, 32(3s), 9 – 17. https://doi.org/10.53656/str2024-3s-1-mod

Biolcheva, P. & Valchev, E. (2023). Increasing CSR Through a Methodology for Intelligent Personal Efficiency of Employees. Strategies for Policy in Science and Education, 31(6s), 126 – 137. http://dx.doi.org/10.53656/str2023-6s-11-inc

Bishop, G. (1960). Charles H. Dow and the Dow Theory. Appleton-Century-Crofts.

Chamber of Independent Appraisers in Bulgaria (CIAB). (2018). Bulgarian Valuation Standards. https://private.ciab-bg.com/uploads/common/g31pb9vntkf5q6aw.pdf

Copeland, T., Koller, T. & Murrin, J. (2000). Valuation – Measuring and Managing the Values of Companies. John Wiley Sons.

Damodaran, A. (1994). Damodaran on Valuation. John Wiley & Son.

Damodaran, A. (2001). Corporate Finance: Theory and Practice. (2nd Ed.). John Wiley & Sons.

Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. (3rd Ed.). John Wiley & Sons.

Dimitrov, I. & Gigov, R. (2022). Increasing the Supply Chain Competitiveness of Bulgarian Companies by Applying Blockchain Technology. V International Conference on High Technology for Sustainable Development (HiTech), 98 – 101. https://doi.org/10.1109/HiTech56937.2022.10145534

Dimitrov, I., Gigov, R. & Dimitrova, A. (2022). Leading Factors for Blockchain Technology Implementation in the Business Organisations in the Bulgarian Context. Entrepreneurship and Sustainability Issues, 10(2), 255 – 273. http://doi.org/10.9770/jesi.2022.10.2(16)

Dimitrova, K. (2024a). A Model for Reengineering the Company’s Business Processes, Based on the Zero Approach Concept. International scientific journal Industry 4.0, 9(1), 25 – 28.

Dimitrova, K. (2024b). Waste Reduction – A Factor for Intelligent and Sustainable Growth and Higher Competitiveness. International scientific journal „Innovations“, 10(1), 10 – 13.

Dimitrova, K. (2018). Modeling, Measurement and Management of Business Processes in Organization. In A. Abraham et al. (Eds.), Proceedings of the Second International Scientific Conference “Intelligent Information Technologies for Industry” (IITI’17) (pp. 410 – 419). Springer Cham. https://doi.org/10.1007/978-3-319-68324-9_45

Dimitrova, K. & Kadieva, Z. (2023). A Model for Evaluating Information Security Systems in Industrial Enterprises and Assessing Its Impact on Increasing the Competitiveness of Enterprises. Journal scientific and applied research, 24(1), 102 – 115. https://doi.org/10.46687/jsar.v24i1.373

Gupta, S., Hanssens, D., Hardie, B., Kahn, W., Kumar, V., Lin, N., Ravishanker, N. & Sriram, S. (2006). Modeling Customer Lifetime Value. Journal of Service Research, 9(2), 135 – 155. https://doi.org/10.1177/1094670506293810

International Valuation Standards Council (IVSC). (2017). International Valuation Standards. https://www.ivsc.org/consultations/ivs-2017/

Jiang, B. & Koller, T. (2007). How to Choose between Growth and ROIC. McKinsey on Finance, 19 – 22.

Koller, T., Goedhart, M. & Wessels, D. (2015). Valuation: Measuring and Managing the Value of Companies. (6th Ed). John Wiley & Sons.

Martin, D. & Petty, W. (2000). Value Based Management – The corporate response to

the shareholder revolution. Oxford University Press.

Madden, B. (1998). The CFROI Valuation Model. Journal of Investing, 7(1), 35 – 47.

Madden, B. (1999). CFROI Valuation: A Total System Approach to Valuing a Firm. Butterworth-Heinemann.

Pratt, S. P. (2008). Valuing a Business: The Analysis and Appraisal of Closely Held Companies. (5th Ed). The McGraw-Hill Companies.

Sven, S., Mehrdad, B., & Patrick, V. (2008). The Granularity of Growth: How to Identify the Sources of Growth and Drive Enduring Company Performance. McKinsey & Company.

Vostrikova, Е. & Meshkova, А. (2020). ESG-kriterii v investirovanii: zarubejnii i otechestvenii opit. Finansovii jornal, 12(4), 117 – 129.